Tax is an increasingly important issue in today’s society. The Archbishop of Canterbury recently spoke out both about the need for taxation to address the increasing inequality in our society, and the way firms like Amazon avoid paying their fair share.

Taxes don’t get vast attention in the Bible, at least overtly. However there are sufficient references that make it clear there was a taxation system, even in Old Testament times, and that tax is a serious issue.

This becomes particularly clear in the New Testament. Luke’s Gospel tells us a census, doubtless for tax purposes, was the reason why Bethlehem is the place in which, by tradition, Jesus was born.

Those scholars who have sought to uncover and understand the economic system in which Jesus grew up, taught and preached tell us the system of taxes was extremely burdensome on the ordinary people. There were taxes to be paid to the Temple, the Romans and the Galilean kings, including in Jesus’s time, King Herod. The rural labourers and peasants who doubtless formed the majority of Jesus’s audiences were severely squeezed by these financial pressures.

Out of his engagement with Zacchaeus, with the Pharisees over a Roman coin and in the turning over of the money-changers’ tables in the temple, I believe we can make an indisputable case for Jesus being firmly on the side of tax justice.

Old Testament economics

The Law undergirds the whole of the Hebrew scriptures. Interweaved within the five Torah Books (the first five in the Bible) is an extremely radical economic system, says US theologian Ched Myers.

The first lesson of the people of Israel as they leave slavery in Egypt is economic, the tale of the manna (Exodus 16). It illustrates Yahweh’s alternative to the oppressive Egyptian model. Bread ‘raining from heaven’ symbolises God’s good gifts – but the people are told not to gather too much, and not to gather on the Sabbath.

The manna cannot be stored, it must be eaten the following morning. Surplus is not appropriate for God’s people; it will lead to trouble. Wealth should circulate; redistribution is the order of the day.

Later, when the quails came, those who tried to eat too many of them were very sick, and many died (Numbers 11: 32-34).

Taxation in the New Testament

Luke’s Gospel is organised around the proclamation of Isaiah 61 that the gospel is good news for the poor. In Jesus’ day debt cancellation and land restoration would be such good news. Jubilee consciousness defined Jesus’ call to discipleship and it lay at the heart of his teaching and the centre of his conflict with Judean public officials. Jesus is constantly forgiving ‘debts’, of all kinds: he took Sabbath and Jubilee seriously.

Jesus engages with more than one tax collector. He calls Levi to become a disciple (Mark 5: 27-32). Later comes Zacchaeus (Luke 19), although, as Myers points out, Zacchaeus “(rightly) understands this to mean he must first practise substantial economic reparation. It is to this programme of socio-economic ‘levelling’ that the official adjudicators of debt object” (then and now!). Incidentally, when Levi leaves his seat of custom to follow Jesus, the Greek word used is aphiemi, which also means ‘forgive sin/cancel debt’.

Then there is the specific tax-related story of the unlikely coalition of Pharisees and Herodians who seek to trap Jesus with the Roman coin test (Mark 12: 13-17). They begin with flattery but the question they pose is sharp, both in Jesus’ own day and in Mark’s community 30 years later.

In his very skilful answer Jesus uses the verb imperative apodete, usually translated ‘render’ but, says Myers, a word which is best understood as “repay”. Note the antithetical nature of the phrases, ‘Repay to Caesar what is due to Caesar and to God what is due to God’. No Jew could possibly compare the debt Israel owes to Yahweh with anything Caesar may claim. Jesus’s message is clear – where do your loyalties lie? This is what leaves the authorities in such confusion.

As the use of foodbanks increases and wages stagnate, while the income of the super-rich balloons and companies like Facebook and Google pile up massive profits with minimum tax, it behoves Christians to say tax is good and even to love tax. Get involved in the conversation at Church Action for Tax Justice (CAT).

Rev David Haslam is Chair of Church Action for Tax Justice and author of The Bible and Tax, which is available from CAT.

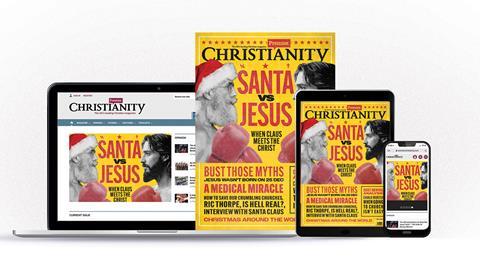

SPECIAL: Subscribe to Premier Christianity magazine for HALF PRICE (limited offer)